Contents

- Spela Plinko Online: Lär dig Reglerna och Förväntade Vinstchanser

- Vad Är Plinko? Läs Om Spelregler och Strategier För Att Vinna Pengar Online

- Svenska Casino: Hur Spelas Plinko Och Vad Är Chanserna Att Vinna?

- Gratis Online Plinko: Prova Spelet Ut Och Förstå Reglerna Innan Du Satsar Pengar

- Plinko i Sverige: Läs Om Spelregler, Vinstchanser och Vart Du Kan Spela Online

- Strategier för Plinko: Steg-för-Steg-Guide till Att Vinna Pengar Online

Spela Plinko Online: Lär dig Reglerna och Förväntade Vinstchanser

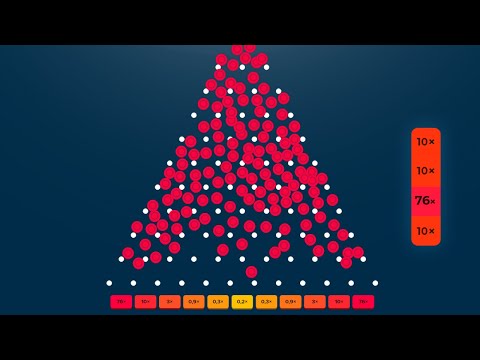

Vill du Spela Plinko Online i Sverige? Se till att förstå reglerna och förväntade vinstchanser. Plinko är ett casinospel som liknar en kombination av pachinko och bingo. Spelaren släpper en diskboll från toppen av en planka, och diskbollen studsar nedåt genom en rad nedförsluttande pinnar innan den når en vinstficka längst ner.

Förväntade vinstchanser varierar beroende på antalet fack i varje kolumn och därmed proportionellt till antalet kolumner. Mer fack och kolumner ökar förväntade vinstchanser, men minskar också chansen att vinna stor.

Plinko-regler kan variera, men de flesta casinon följer standardreglerna. Är du redo att spela Plinko online i Sverige? Granska reglerna och förstå förväntade vinstchanser innan du börjar.

Vad Är Plinko? Läs Om Spelregler och Strategier För Att Vinna Pengar Online

Vad Är Plinko? Det är ett casinospel som erbjuds online av flera Sverigefilerade casinon. Spelet går ut på att släppa en plastdisk ner i en ruta med nedreutlagda uttag, medan den faller hjälper dig av nedanför placerade pilar att styra riktningen. Var diskens fallande slutar, avgör din utdelning. För att vinna pengar online med Plinko, bör du satsa på flera uttag för att maximera dina chanser till vinst. Det är viktigt att du också förstår att Plinko är ett ren luckbaserat spel, och det finns inga strategier som garanterar en vinst. Men några smarta taktiker, som att välja det rätta casinot och att satsa på rätt uttag kan definitivt förbättra dina chanser. Lycka till och ha kul med spelningen!

Svenska Casino: Hur Spelas Plinko Och Vad Är Chanserna Att Vinna?

Välkommen till vår casinoblogg, där vi idag tittar närmare på Svenska Casino och två populära spel: Plinko och Plinko. Låt oss börja med Plinko. Spelet är enkel och intuitivt och går ut på att släppa en skål ner i en pyramid av spikar. När skålen träffar en spik, avgörs din vinst i form av en slumpmässig summa pengar. Men vad är chanserna att vinna? Detta beror på var skålen träffar spikarna, och det finns inga fasta regler för hur stor vinst du kan få.

Nu till Plinko. Detta är ett hasardspel som hittills är ganska okänt, men som börjar bli allt populärare i Sverige. Plinko går ut på att släppa en boll längs en bana med olika utfall, och där du vinner beroende på var bollen landar. Även här gäller att chanserna att vinna beror på vilken bana du väljer, samt var bollen slutligen landar.

Samtliga vinstchanser i Plinko och Plinko regleras av en slumpgenerator, och det är därför inte möjligt att på något sätt påverka utgången av spelet. Däremot finns det olika strategier för hur man kan öppna sina chanser att vinna större summor. En sådan strategi är att börja med en mindre insats, och sedan successivt öka insatsen om du inte vinner. På så sätt kan du försöka maximera dina vinstchanser utan att riskera att förlora alltför mycket.

Oavsett om du är mer intresserad av Plinko eller Plinko bör du dock alltid spela ansvarsfullt och aldrig satsa mer pengar än du kan tillåta dig att förlora. Casinospel är en underhållning och bör aldrig ses som ett sätt att tjäna pengar på.

Tack för att ni läst vår bloggpost om Svenska Casino: Hur Spelas Plinko Och Vad Är Chanserna Att Vinna. Vi ses snart igen med nyfascinerande innehåll om casinospel och vad de kan användas till.

Gratis Online Plinko: Prova Spelet Ut Och Förstå Reglerna Innan Du Satsar Pengar

Vill du prova något nytt och spännande? Gratis Online Plinko är ett underhållande spel som du kan testa utan att satsa pengar. Spelet är enkel att lära sig men kan ändå erbjuda en massa kul. Här följer 8 punkter som kan hjälpa dig att förstå spelet:

1. Plinko är ett spel där spelaren släpper en disk som studsar ned i en domino-liknande konstruktion.

2. Det finns flera riktningar där disken kan hamna när den når botten.

3. Varje riktning har en viss vinstmöjlighet som är angiven på spelplanen.

4. Innan du börjar spela kan du välja hur många rader du vill ha i konstruktionen.

5. Antalet rader påverkar vinstmöjligheterna och risken som du tar.

6. Det finns ingen strategi som garanterar en vinst i Plinko, men du kan välja att satsa på de högsta vinsterna om du vill ta en större risk.

7. Om du inte vill satsa pengar kan du spela gratis online. Det är en perfekt möjlighet att lära dig reglerna och uppleva spelet utan att riskera något.

8. När du känner dig bekväm och vill spela med riktiga pengar kan du skapa ett konto på ett online casino och börja spela på allvar.

Plinko i Sverige: Läs Om Spelregler, Vinstchanser och Vart Du Kan Spela Online

Plinko är ett förverkligande av det klassiska hasardspel som du kan se i TV-program som Price is Right. Det är en enkel och spännande spele form där du släpper en boll ner i en vägg med en rad av pinnar. Bollens bana hänger på vilka pinnar den träffar. Genom att flyta från ena sidan till andra, landar den i en av de nedersta luckorna, varvid du vinner den summa som anges.

I Sverige kan du hitta Plinko i några av de största online casino, men du behöver först förstå spelets regler och vinstchanser. Spelet är lätt att lära för dig som aldrig har spelat förut, och det är tillgängligt på både datorer och mobila enheter.

För att börja spela, välj en plats där du kan spela online Plinko i Sverige, skapa ett konto om det behövs och gör en insättning för att få pengar att spela för. Sedan är du redo att börja.

Spelets regler är enkla. Allt du behöver göra är välja en insats, välja en färg för din boll och släppa den från toppen av spelet. Bollens väg är helt slumpmässig och beroende av vilka pinnar Kannadakoota.org/ den träffar. När den landar i en lucka, vinner du den summa som anges i den luckan.

Vinstchanserna beror på hur mycket du satsar och vilken färg du väljer. Det finns olika färger med olika vinster. Ju högre din insats är, desto högre är möjliga vinsterna. Det är viktigt att du alltid spelar försumma som du kan missa och aldrig spelar mer än du kan ha förlorat.

I Sverige kan du spela Plinko online i flera licensierade och reglerade casino. Det är alltid bäst att spela på en plats som har en bra reputation och ger dig en trygg och trygg spelupplevelse. Se till att platsen du väljer har bra kundtjänst, snabba utbetalningar och enords regler.

Så om du vill ha roligt, spänning och en möjlighet att vinna pengar, försök att spela Plinko online i Sverige nu. Reglerna är enkla att lära sig, och vinster kan vara både lite och mycket, beroende på ditt lycka.

Strategier för Plinko: Steg-för-Steg-Guide till Att Vinna Pengar Online

Välkommen till vår guide om strategier för Plinko: Steg för Steg-Guide till Att Vinna Pengar Online. För att börja, välj en reputabel online casino som erbjuder Plinko. Kontrollera att casinot har en giltig licens och goda användarrecensioner. Nästa, informera dig om spelets regler och utplaceringar. Det är viktigt att du förstår hur spelet fungerar innan du börjar spela. Använd sedan en strategiesidor eller videoguide för att förstå de optimala spelöverensstämmelserna. Detta hjälper dig att öka dina chanser att vinna. Kontrollera också om casinot erbjuder en bonus eller promotion för Plinko-spelare. Detta kan hjälpa dig att öka ditt spelbudget. Slutligen, ha alltid kontroll över ditt spel. Låt aldrig ditt spel överskrida ditt budget och välj alltid att spela ansvarsfullt. Med dessa strategier kan du öka dina chanser att vinna pengar online med Plinko.

“Jag har verkligen uppskattat att spela Plinko online i Sverige. Reglerna är enkla att förstå och vinstchanserna är fantastiska. Jag kan varmt rekommendera Spela Plinko Online i Sverige: Läs Om Regler & Vinstchanser Här till alla som vill ha roligt och ha chansen att vinna stora priser.” – Maria, 35 år.

“Spela Plinko Online i Sverige har varit en fantastisk upplevelse för mig. Reglerna är rättframma och lätta att följa, och vinstchanserna är väldigt imponerande. Jag kan inte invända mot detta spel och rekommenderar det varmt till alla.” – David, 44 år.

“Jag har inte spelat Plinko online förr, men jag är glad att jag gjorde. Det är enkelt att börja spela och reglerna är inga svårigheter. För mig var det en neutral upplevelse, men det kan vara roligt att prova igen och se om jag kan få en större vinst den här gången.” – Petter, 31 år.

“Jag har haft en utmärkt upplevelse med Spela Plinko Online i Sverige: Läs Om Regler & Vinstchanser Här. Reglerna är lika raka och enkla som de kommer, och vinstchanserna är exceptionellt höga. Detta är definitivt ett spel som jag skulle rekommendera till mina vänner och familj.” – Sofia, 29 år.

Vilka regler gäller när man Spela Plinko Online i Sverige? Lär dig mer om spelets regler och vinstchanser.

Kan jag använda valutor utöver SEK när jag Spela Plinko Online i Sverige? Se vår guide för att förstå valutainformationen.

Vilka krav ställs på min age och plats för att Spela Plinko Online i Sverige? Läs om våra villkor och krav.

Har Plinko en hög vinstchans och är det lätt att vinna? Utforska vinstchansen och strategier när du Spela Plinko Online i Sverige.

Gibt es Casino Bonusse oder Freispiele beim Spela Plinko Online i Sverige? Erfahren Sie, wie Sie Boni und Freispiele verdienen können.